All businesses begin as a flash of inspiration. But no matter how brilliant the flash, an idea won’t sprout legs and build itself into a successful enterprise. A business doesn’t become a business unless someone has the focus, skill, and commitment to push it past the logistical hurdles inherent to doing something that's never been done before. That's when the work of an entrepreneur begins. And it isn’t easy. But it starts with getting informed about the landscape of commerce—and specifically, payment processing. Forewarned is forearmed, after all. That’s where the SwipeSum comparison platform and tools come in.

All businesses begin as a flash of inspiration. But no matter how brilliant the flash, an idea won’t sprout legs and build itself into a successful enterprise. A business doesn’t become a business unless someone has the focus, skill, and commitment to push it past the logistical hurdles inherent to doing something that's never been done before. That's when the work of an entrepreneur begins. And it isn’t easy. But it starts with getting informed about the landscape of commerce—and specifically, payment processing. Forewarned is forearmed, after all. That’s where the SwipeSum comparison platform and tools come in.

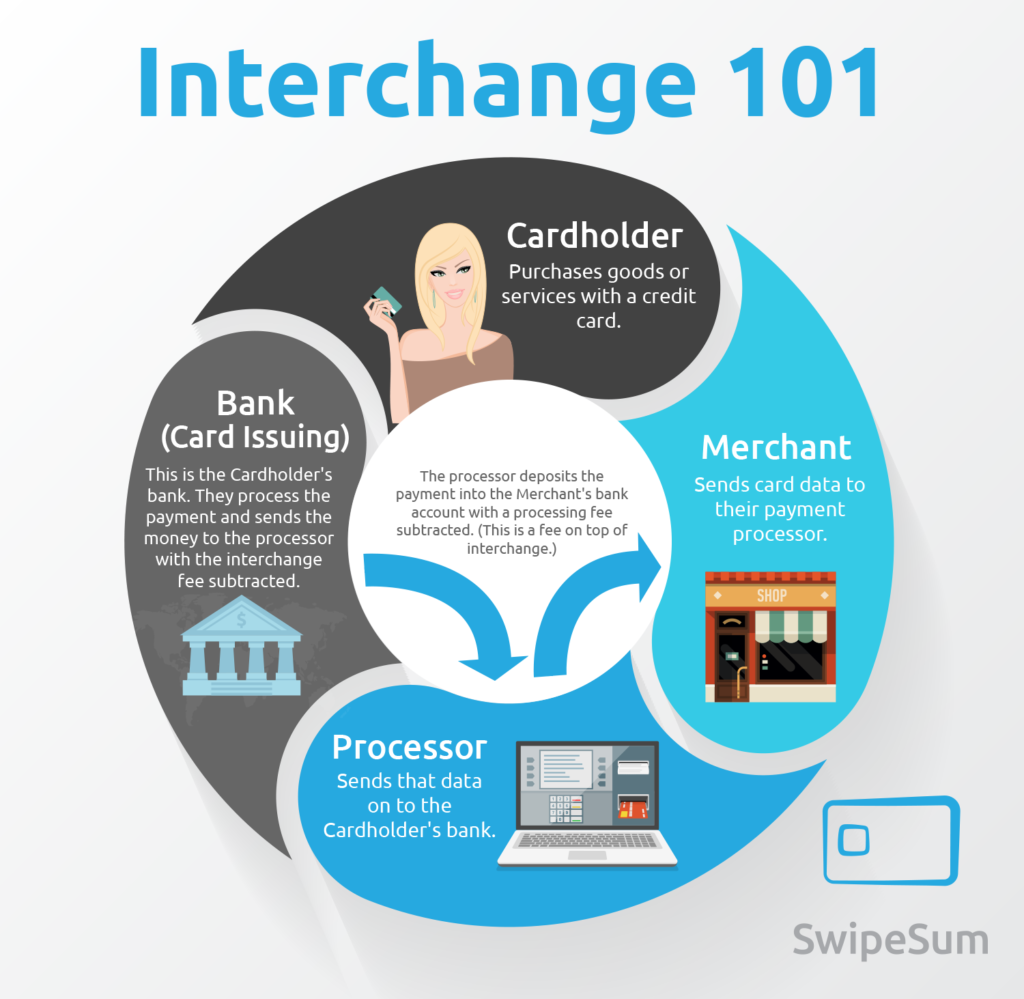

Though many fledgling business owners don’t realize it at first, one of the most important decisions made on the road to profitability is how to process payment. So, what does that mean? Well, to succeed in a market that’s fueled by technology, a business has to be able to process virtual money—no cash-only storefronts here. In order to accept credit cards, a company has to work with a credit card processor, whose job is basically to get the money from the purchaser’s bank account into yours.

Like everything else in the business world, getting that money from point A to point B comes at a price. That price is what’s known as Interchange. Interchange is a pre-set rate that a processing company pays to the bank that issued the card being charged. The above graph is a simplification, but here's generally how it works. Say you bank with Bank A and you signed up for an XYZ credit card through them. Any time that card is used to make a purchase, the processing company that communicates with your bank — in this case, Bank A — collects a certain amount of money for Bank A. The Interchange rate is made up of two elements: 1. a percentage fee of the volume of the sale2. a per-transaction fee. So, using the example of a $100 sale with the Bank A-issued XYZ card, the Interchange rate could be something like 1.65% (the per-transaction fee) + $0.10 (the volume-related fee).

While business owners know that processing companies earn money by taking a percentage of the interchange, many of them don’t realize how much they could save on these costs just by choosing a merchant processor. So, here are the two main ways service providers will charge merchants: tiered pricing and Interchange-plus pricing.The majority of merchant service providers use tiered pricing, which means there will be a low qualified rate (meaning certain cards will qualify for a very low processing rate), but the majority of cards will not qualify, and therefore be processed at the unqualified rate. The majority of merchant services providers TRY to use tiered pricing, because it's the most profitable for them. With SwipeSum, you will never be set-up on tiered pricing.The issuing or sponsoring bank sets the qualified rate and also chooses which cards qualify. It’s entirely up to them. There’s no standard for qualified and unqualified cards across the board, and most merchants in tiered pricing models don’t see any savings, regardless of how low the qualified rate may be.

Say the qualified rate for a credit card is 1.79% + $0.15. Because these cards come with rewards and perks, they come at a higher cost to the card-issuer, which means the card-issuer has to charge a higher rate to recoup their costs. That means these cards won’t be eligible for the qualified rate, and instead, they’ll be processed at the (usually much higher) unqualified rate. Say the service provider sets the surcharge for unqualified cards at 1.54% + $0.08—that amount is added to the qualified rate. So, the elements in a tiered pricing model are: the qualified rate, the unqualified surcharge (paid to the service provider/processor), the card association fees (paid to the credit card company), and the card-issuer fees (paid to the card-issuing bank). (1.79% + 1.54% + 0.13%) = 3.46%($0.10 + $0.08 + $0.02) = $0.20All told, this $100 transaction with a tiered pricing model would cost $3.64. ($100 x 3.44%) + $0.20Another tricky thing about tiered pricing is that businesses using this model rarely share actual interchange rates with the merchant, making it impossible to know how much you’re actually paying the service provider to process the transaction. That’s why interchange-plus is often a much better option.See, Interchange-Plus works by adding a static percentage to Interchange, though it’s still made up of the same two components (a percentage fee of the volume of the sale, and a per-transaction fee). As such, merchants can more clearly see what the Interchange rate is, and how much money went to the provider. Let’s use the same $100 example with Interchange-plus pricing:Interchange Fees (paid to Bank A): 1.65% + $0.10Card Association Fees (paid to XYZ credit card company): 0.13% + $0.02Card Processor Margins (paid to your service provider): 0.25% + $0.10Total Fees (total cost of transaction): $2.25Because providers using tiered pricing don’t usually disclose Interchange rates, it’s impossible to know how much a processing company is actually charging for their services. Interchange-plus pricing means the merchant has full visibility of underlying Interchange rates, making the service provider’s profit margin transparent, too. So, whether a merchant is processing at a high volume or just a few smaller transactions, the cost will always be proportional to the activity. Transparency, consistency, and economy—that’s just good business. And at SwipeSum, we're here to help you navigate the world of processing by finding the deal that works for you.

RECOMMENDED

HELPFUL CONTENT

Request a CONSULTATION

Meet one of our payments experts to see if working together makes sense.

We will schedule a quick consultation call to go over how you're currently handling merchant services, and present a proposal at no cost.

.jpg)

.jpg)

By submitting this form you agree to receive information about Swipesum product updates via email as described in our Privacy Policy and Terms & Conditions.