The good news is, there’s a place where all that stuff is recorded: your monthly processing statement.Yes, your monthly statement. The pages long, tiny-text, convoluted nightmare that inevitably ends up in your accountant’s file cabinet before anyone has given it a glance. Turns out there’s some valuable information hidden in its pages -- information that can save your company a lot of money.

I’m a veteran of the payments industry. I spent several years working in sales for one of the largest processors in the world, and nowadays, I’m the CEO of SwipeSum. I spend my days trying to eliminate processing fees and find great rates for businesses of all sizes. I love what I do, but in reality, SwipeSum would fail if it weren’t for one undeniable fact: the payments industry is messy.It didn’t get that way by mistake though. Many merchants just accept payment processing as a necessary evil, which it is. You can’t really run a successful business without accepting card payments. People just aren’t keeping cash in their pockets anymore. Sadly, big processors take advantage of that fact. Business owners all around the world are overpaying for processing, many of whom don’t even realize it.So today I wanted to write something that could help those business owners. You guys don’t deserve to be gypped by the tiered pricing and hidden charges that run rampant in the payments industry. The good news is, there’s a place where all that stuff is recorded: your monthly processing statement.Yes, your monthly statement. The pages long, tiny-text, convoluted nightmare that inevitably ends up in your accountant’s file cabinet before anyone has given it a glance. Turns out there’s some valuable information hidden in its pages -- information that can save your company a lot of money. The problem? They’re too damn confusing! I’ve read literally thousands of statements in my lifetime, and I still find new surprises on a regular basis. You may not be able to understand every part of your payments statement, but here are a few things to look out for when reviewing your next monthly statement:Note: All examples used in this article are taken from real statements.

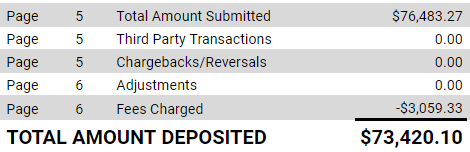

Processors employ great salespeople. They know that payment processing is a commodity; nobody is going to pay higher rates for a service that is exactly the same as what a competitor offers. Salespeople try to make their price appear as low as possible, while also trying to pad their margin with as many fees as possible.You wouldn’t believe how many people come to SwipeSum and say “Look! I’m paying just three cents per transaction,” but then also pay hundreds and hundreds of dollars per month in unnecessary fees. Your first step in evaluating your payment processing statement is to calculate your effective rate. Just take the total amount of fees charged by the processor, divide it by the total revenue before fees, and BOOM! There’s you’re effective rate, the percentage of revenue you’re paying to your processor, card company, and bank each month.Here's an example:

In this statement, the processor makes it easy to calculate the effective rate as all the fees paid out are shown in one place. You may have to search for your total amount submitted and total fees charged, but even if they’re not in one place, they will be listed. These numbers indicate that this company is paying an effective rate of nearly 4%. This was much, much higher than their processor had quoted for them.The business that sent me this statement isn’t an outlier, though. In fact, most business owners are seeing effective rates much higher than what their processors have promised. If this applies to you, it’s time to go fee hunting.

First, let’s talk interchange. It’s pretty complicated in itself (and it’s also constantly changing), but the simplest definition I can offer is that it’s the cost of completing a transaction. Interchange is not set by your processor. It’s set by the card companies and banks and is intended to support the infrastructure that goes into completing your transaction: Computer servers, verification systems, the IT guys who keep it all updated, all that jazz. It also funds the rewards programs that your card company offers. Different rates are charged to different cards, so a debit card costs less than a “titanium rewards plus” card to process. Most statements will list out these different rates one-by-one. These rates can’t be negotiated, so don’t spend too much time poring over them.There is something that you should keep an eye out for, though: Interchange padding. This is a particularly seedy practice that many processors will use to hide fees. When looking through the interchange section of your statement, keep an eye out for descriptions that are labeled “fee” or “charge”. Interchange rates should be easily identifiable -- they’re written out just as your rates should be, as a percentage plus a set amount. Because the percentages are so specific, interchange fees typically don’t come out looking friendly. Take a look at this example from an actual statement. The two fees included in this section are pretty clear when compared to the typical interchange charges (descriptions have been removed to protect the identity of the business involved):

My rule of thumb is this: if you find a nice, round number (like $5.00 or $19.95) anywhere on your statement, you’ve probably found a fee. Percentage-based interchange rates and processor rates rarely add up to pretty numbers. Fees always do.

Not all fees are hidden deep in your statement. In fact, some fees are even advertised in your statements months before you’re charged for them. Processors are required by law to inform customers when a new fee will be added to their contract, so if you pay close attention, you can catch unnecessary fees before you’re hit with them.So where can you find these fees? They’re actually right out in the open, not in the fine print or footnotes. Most merchants don’t actively read their statements. They might glance over transactions or fees to make sure everything looks right, but they’ll ignore the page of text that comes in the middle. That page will inform you of new fees, and policy changes that might result in additional fees being charged to you. Don’t ignore this stuff. Instead, ask your processor if they can waive the fee. They usually will if you do the work to catch it on your own. They’re not hard to find. Even just skimming the paragraph for numbers should be enough to locate them.While these three tips might not make you a statements expert, I hope you’re a little closer than you were when you first opened this article. Don’t let the complexity of your statement prevent you from finding opportunities to save your company money. And if you’re not sure, contact us at SwipeSum. We’ll review your statements and point out any fees we find, and we’ll even try to find a processor that will treat you better. Plus, we do it for free.

RECOMMENDED

HELPFUL CONTENT

Request a CONSULTATION

Meet one of our payments experts to see if working together makes sense.

We will schedule a quick consultation call to go over how you're currently handling merchant services, and present a proposal at no cost.

.jpg)

.jpg)

By submitting this form you agree to receive information about Swipesum product updates via email as described in our Privacy Policy and Terms & Conditions.