Learn about Chase Paymentech's payment processing solutions, PCI compliance requirements, and phone support options to secure your business effectively.

Chase Paymentech was founded in 2000 as a joint venture between JPMorgan Chase Bank and Paymentech, the company has grown to become a dominant player in the payment processing landscape. JPMorgan Chase & Co. has played a significant role in shaping Chase Paymentech's offerings and customer relationships. With a focus on security, innovation, and customer satisfaction, Chase Paymentech caters to a wide array of businesses, from small startups to large enterprises. But as the payment processing environment becomes increasingly complex, how can businesses navigate this terrain effectively?

Enter Swipesum, a trusted partner committed to optimizing payment solutions for its clients. For the lowest Chase rates and premium support, contact us today!

Chase Paymentech is an American payment service provider and merchant acquiring business that is part of JPMorgan Chase, supporting businesses in processing payments. The company provides a range of associated business services, including analytics, payment fraud detection, and data security, positioning itself as a leading provider of payment solutions. This is vital for helping businesses manage online transactions and significantly reduce payment fraud. JPMorgan Chase Bank is also liable for customer testimonials and experiences related to these services.

As of 2012, Chase Paymentech processed an impressive 29.5 billion transactions with a total value of $655.2 billion. This substantial figure reflects the company’s integral role in the U.S. payment processing landscape. Chase Paymentech was established through the acquisition of various companies, including MNet, JL McKay, Litle, and DMGT in the late 1990s, and later merged with JPMorgan Chase in 2004.

Chase Paymentech is not merely a payment processor; it is a comprehensive solution provider. The introduction of their Future Proof Terminal represents a significant leap forward, allowing merchants to accept a multitude of payment methods, including EMV chip cards, mobile wallets, contactless payments, and integrating a card reader for seamless credit and debit card processing. As Mike Duffy, president of Chase Paymentech, noted, “Merchants are looking to make the customer check-out process as easy and safe as possible.”

This innovation comes at a critical time when businesses are grappling with the increasing demand for contactless payments, fueled by the pandemic’s lingering effects. With this terminal, merchants can expect fewer chargebacks and a reduction in fraud-related costs, allowing them to focus more on growth and less on mitigating risks.

To get started with Chase Payments, interested businesses can visit Chase’s website and sign up for a merchant account. The application process is straightforward: business owners simply need to fill out the online application and provide the required business information. Once approved, they will receive a welcome package containing instructions on setting up their payment processing system. For those needing assistance during setup, Chase’s customer support team is readily available.

It’s crucial to review and agree to Chase’s terms and conditions, including their privacy and security policies, to ensure a smooth onboarding process.

While Chase Paymentech provides powerful tools for payment processing, navigating the complexities of merchant accounts can still be daunting. That’s where Swipesum steps in. As a premier payments consultant, Swipesum specializes in helping businesses optimize their payment solutions with a tailored approach. We serve as your Chief Payments Officer (CPO), offering strategic insights and support to ensure that your payment processing aligns with your business goals.

One of the unique advantages of partnering with Swipesum is our in-depth understanding of the Chase Paymentech ecosystem. Our team helps clients with account setup, integration, and ongoing management, ensuring that you leverage all the features and benefits available to you. For instance, a local restaurant chain recently approached us after experiencing high transaction fees with its existing payment processor. After a comprehensive review, Swipesum was able to negotiate better terms with Chase Paymentech, resulting in a 65% reduction in fees. "Swipesum took the hassle out of payment processing," said the restaurant’s owner. "They not only saved us money but also helped us improve our overall operations."

At Chase Paymentech, we are committed to providing exceptional support to our clients, ensuring that all your payment processing needs are met efficiently. Below is a comprehensive support section that addresses common inquiries and provides resources to help you navigate our services.

Navigating the complexities of payment processing goes hand in hand with ensuring your business adheres to the highest security standards. One crucial aspect of this is achieving PCI compliance, which refers to the Payment Card Industry Data Security Standards (PCI DSS). These standards were established to protect cardholder data and reduce payment fraud, making compliance essential for any business that processes credit card transactions.

PCI compliance encompasses a set of requirements designed to secure card information during transactions. The standards require businesses to implement a series of security measures, including the use of firewalls, encryption of cardholder data, and regular monitoring of networks. Essentially, businesses must demonstrate that they have taken necessary steps to protect sensitive information, including restricting access to cardholder data and maintaining a documented security policy.

The PCI DSS outlines 12 key requirements that businesses must follow, including implementing strong access control measures, regularly monitoring and testing networks, and maintaining a vulnerability management program.

For many businesses, becoming compliant may seem daunting, but with the right guidance, it can be manageable and cost-effective.

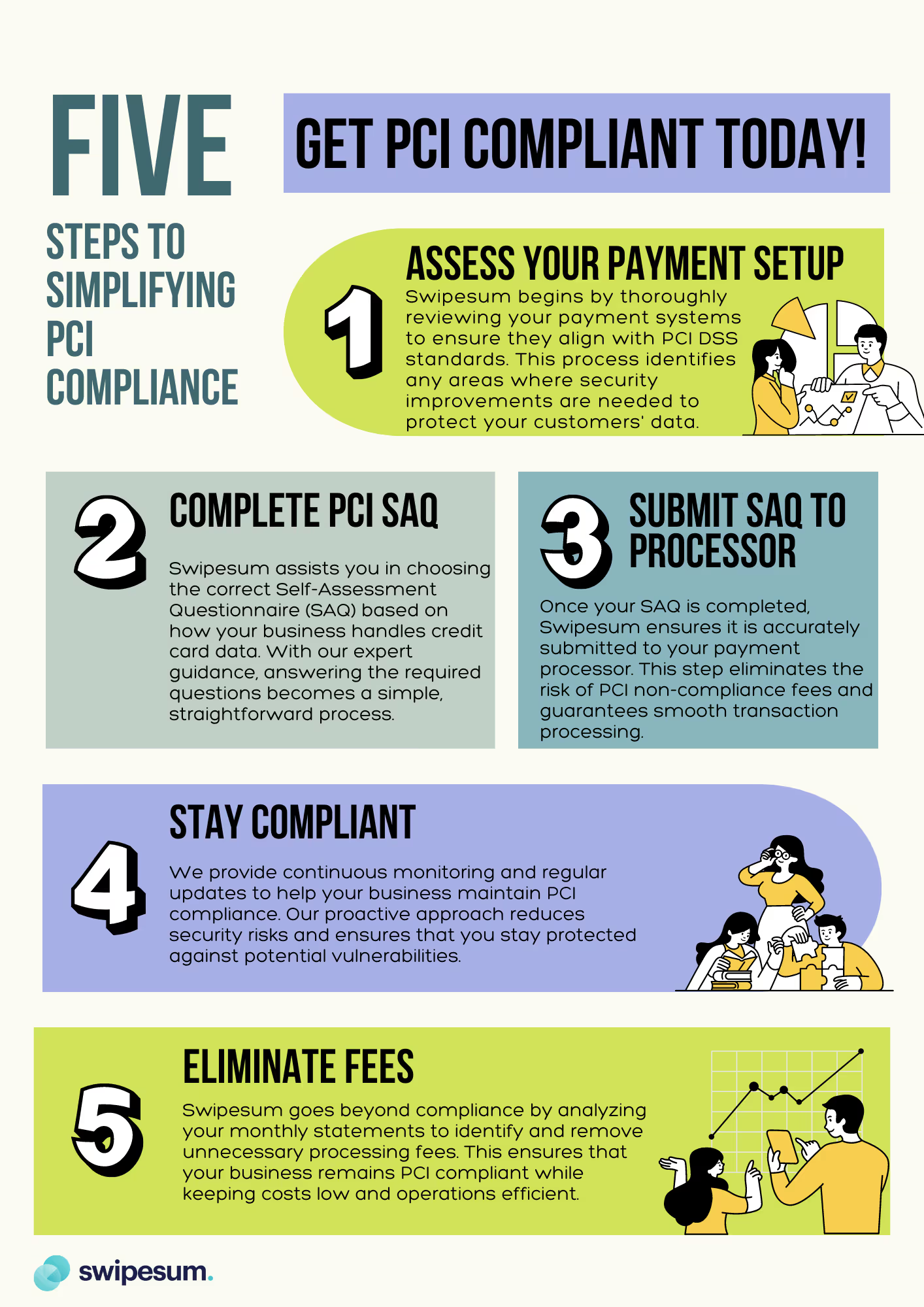

At Swipesum, we understand that achieving and maintaining PCI compliance is not just a regulatory obligation but a critical component of protecting your business and your customers. Our expertise in the payments landscape enables us to offer tailored support to ensure your compliance efforts are effective and aligned with industry standards.

One of the significant advantages of partnering with Swipesum is our commitment to helping businesses navigate the complexities of PCI compliance without incurring additional fees. Many processors charge compliance fees, but at Swipesum, we provide support for PCI compliance at no extra cost.

Our team assists businesses in completing the required Self-Assessment Questionnaire (SAQ), ensuring that all necessary steps are taken to avoid penalties and maintain compliance.

Additionally, our approach is proactive. We help identify potential vulnerabilities in your payment processing systems, ensuring you stay ahead of security threats. With our guidance, you can avoid common pitfalls that lead to non-compliance fees and penalties, allowing you to focus on running your business rather than worrying about compliance.

Once businesses are set up with Chase Payments, they can easily manage their accounts online. This includes viewing transaction history, managing payment settings, and utilizing the Chase Paymentech dashboard to monitor account activity. For added convenience, merchants can use the mobile app to manage their accounts on the go.

It’s essential to keep account information up-to-date, including business addresses and contact details. Account management tools also allow businesses to set up recurring payments and manage subscriptions effectively.

Chase Paymentech offers a diverse range of payment processing options, including credit card processing, debit card processing, and mobile payments. Merchants can also use Chase Paymentech to process mail order payments and phone order payments. The company supports a variety of payment terminals, including card readers and mobile wallets, ensuring that businesses can cater to their customers’ preferred payment methods.

For e-commerce transactions, Chase Paymentech provides a robust platform that integrates seamlessly with various online shopping carts, enabling businesses to expand their reach and improve customer satisfaction.

Security is paramount in payment processing, and Chase Paymentech excels in providing robust payment security and fraud protection measures. The company employs advanced encryption and tokenization to secure payment data, making it significantly more difficult for fraudsters to intercept sensitive information.

In addition to these protective measures, merchants can utilize Chase Paymentech’s fraud detection tools to identify and prevent suspicious transactions. Regular reviews of security policies and procedures are recommended to maintain compliance and safeguard business operations. Utilizing the test transaction feature is also advisable to ensure that the payment processing system is functioning correctly.

Should businesses encounter any issues with their Chase Payments accounts, the customer support team is available to assist. Online resources and FAQs can help troubleshoot common problems, allowing for quick resolutions. For technical issues with card readers or other devices, contacting the manufacturer or Chase’s customer support team is recommended for efficient support.

Chase Paymentech's offerings include a wide range of products and services, from payment terminals to mobile wallets and online payment processing. The company also provides essential merchant services, including payment processing, account management, and customer support. Businesses can leverage Chase Paymentech’s analytics and reporting tools to track payment activity and optimize operations.

To maximize security, businesses should adhere to cybersecurity best practices. This includes using strong passwords, keeping software updated, and employing two-factor authentication for added security. Reviewing and complying with Chase’s security policies and procedures is critical to safeguarding sensitive information.

Educating employees on these best practices can further prevent data breaches and enhance overall security.

To navigate the payment processing landscape effectively, it is essential to understand key terms. Reviewing the glossary of terms related to payment processing, merchant services, and payment security can be beneficial. This resource helps business owners familiarize themselves with crucial concepts, aiding in informed decision-making.

Many business owners have questions about Chase Payments. Regularly reviewing the FAQs can help clarify common inquiries and offer solutions to issues that may arise. For additional questions or concerns, reaching out to Chase’s customer support team is advisable to ensure thorough understanding and resolution.

Chase Payments is a comprehensive payment processing system that provides businesses with a range of payment options and robust security measures. By following the best practices and guidelines outlined in this guide, you can ensure that your business is secure and compliant with payment processing regulations.

Choosing Swipesum as your partner not only enhances your payment processing capabilities but also empowers your business to thrive in an increasingly digital marketplace. Make sure to review and comply with Chase’s terms and conditions, including their privacy and security policies.

To learn more about how Swipesum can transform your payment processing and optimize your operations, contact us today. With Swipesum, you’re not just choosing a service provider; you’re choosing a partner dedicated to driving your success.

In conclusion, Chase Paymentech stands out as a premier payment service provider, offering a comprehensive suite of products and services designed to help businesses efficiently process payments and manage their online presence. With its robust payment platforms, advanced security measures, and unwavering commitment to customer support, Chase Paymentech is an ideal partner for businesses aiming to expand their digital capabilities.

Whether you’re a small business owner or a large enterprise, Chase Paymentech has the tools and expertise to help you succeed in the digital marketplace. From seamless integration with various payment methods to top-notch fraud protection, the benefits are clear. For more information, visit Chase Paymentech’s website or contact their customer support team at +1 (844) 554-1275.

By choosing Chase Paymentech, you’re not just opting for a payment processor; you’re selecting a partner dedicated to driving your business’s success in an increasingly digital world.

RECOMMENDED

HELPFUL CONTENT

Request a CONSULTATION

Meet one of our payment processing experts to see if working together makes sense.

We will schedule a quick consultation call to go over how you're currently handling merchant services and present a proposal at no cost.

By submitting this form you agree to receive information about Swipesum product updates via email as described in our Privacy Policy and Terms & Conditions.